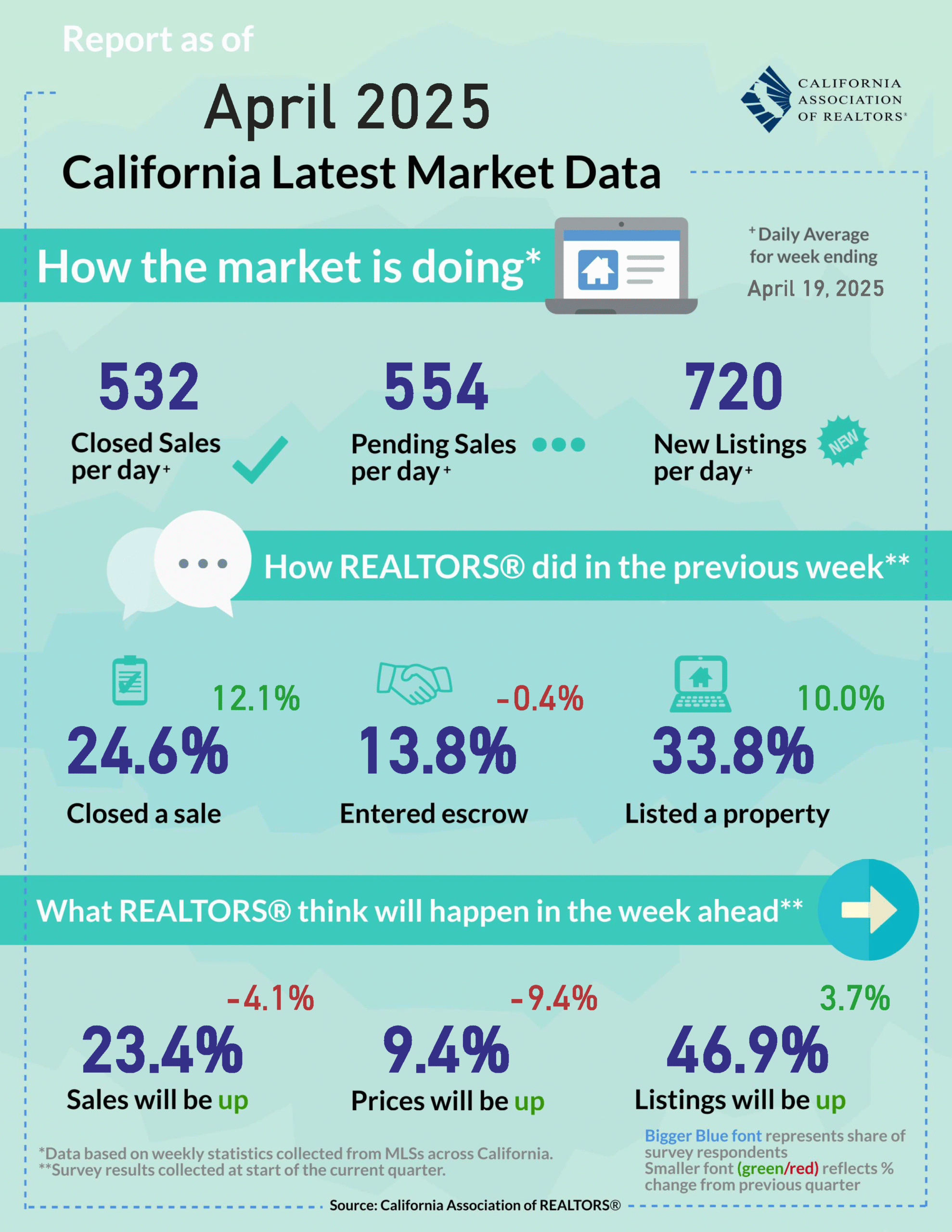

At its May 2025 meetings, the California Association of REALTORS® focused on legislative advocacy, housing market trends, and member resources. Key updates included support for Governor Newsom’s budget provisions aimed at increasing housing supply and streamlining insurance access in wildfire-prone areas. The Board reviewed April’s declining home sales and slight price dip, with discussions centered on improving consumer confidence amid market volatility. Committees also examined proposed revisions to the Residential Purchase Agreement and highlighted upcoming legal webinars and training opportunities for brokers. C.A.R. reaffirmed its commitment to safeguarding professional standards while pushing forward policy efforts to expand housing access statewide.

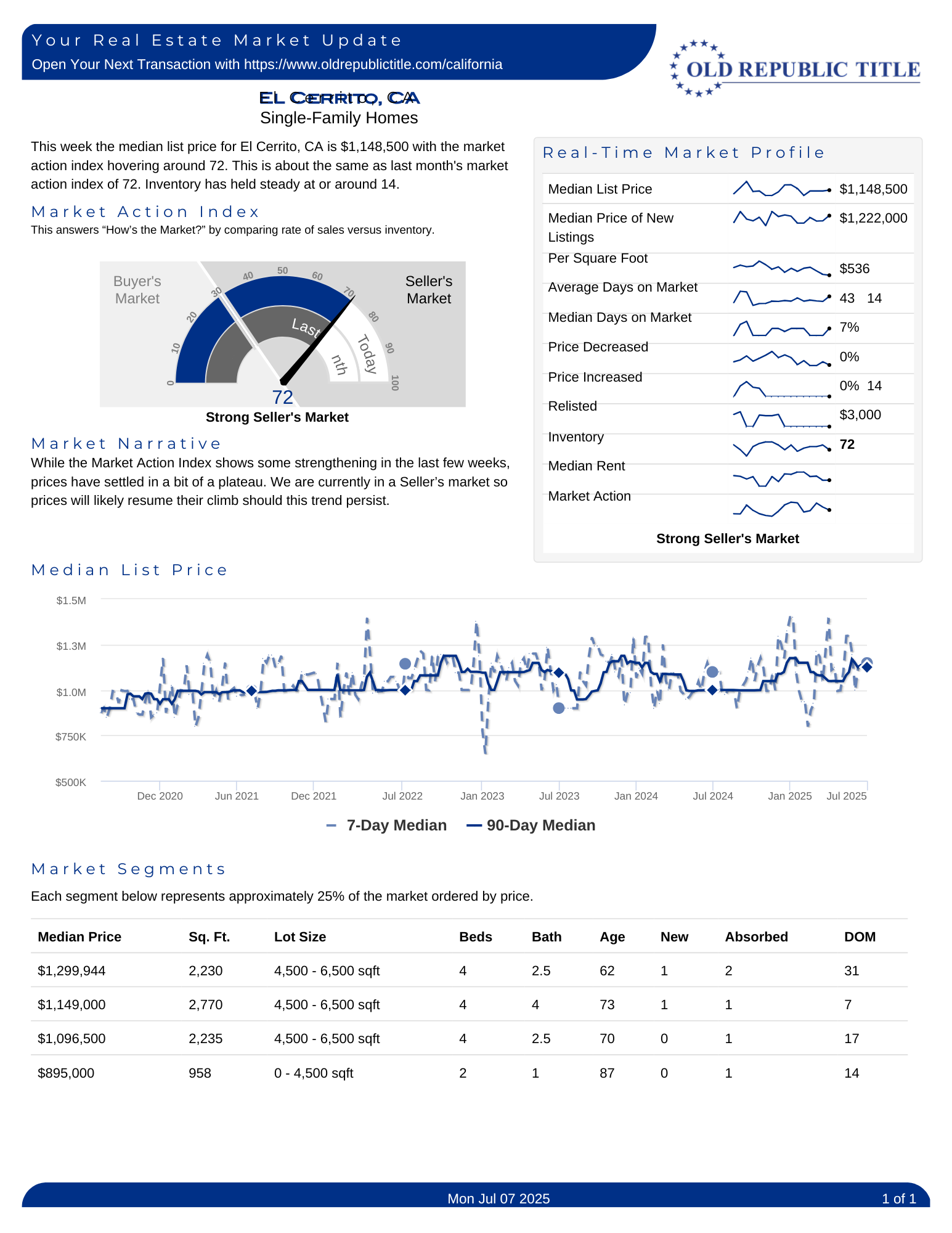

Real Estate Market Update El Cerrito, CA

As of early July 2025, El Cerrito remains a strong seller’s market with a Market Action Index holding steady at 72, consistent with last month. The median list price for single-family homes is $1,148,500, while new listings are priced slightly higher at $1,222,000. Homes are averaging 43 days on market, with nearly no price reductions or increases recorded this period. Inventory remains tight at 72 homes, reinforcing current seller advantages. Despite a recent plateau in prices, continued strong demand and limited supply suggest pricing may resume its upward trend if these dynamics persist.

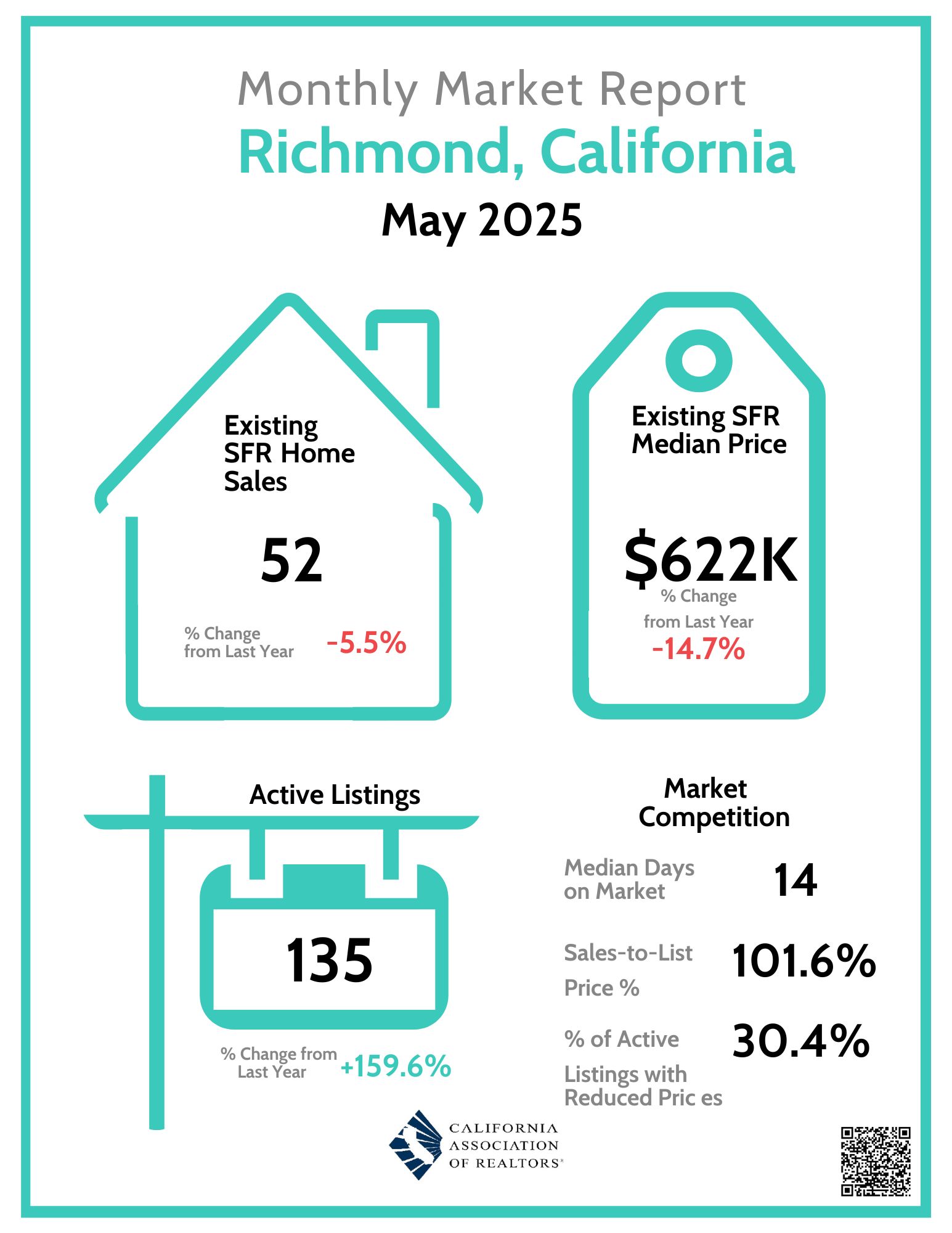

Market Minute Write-Up

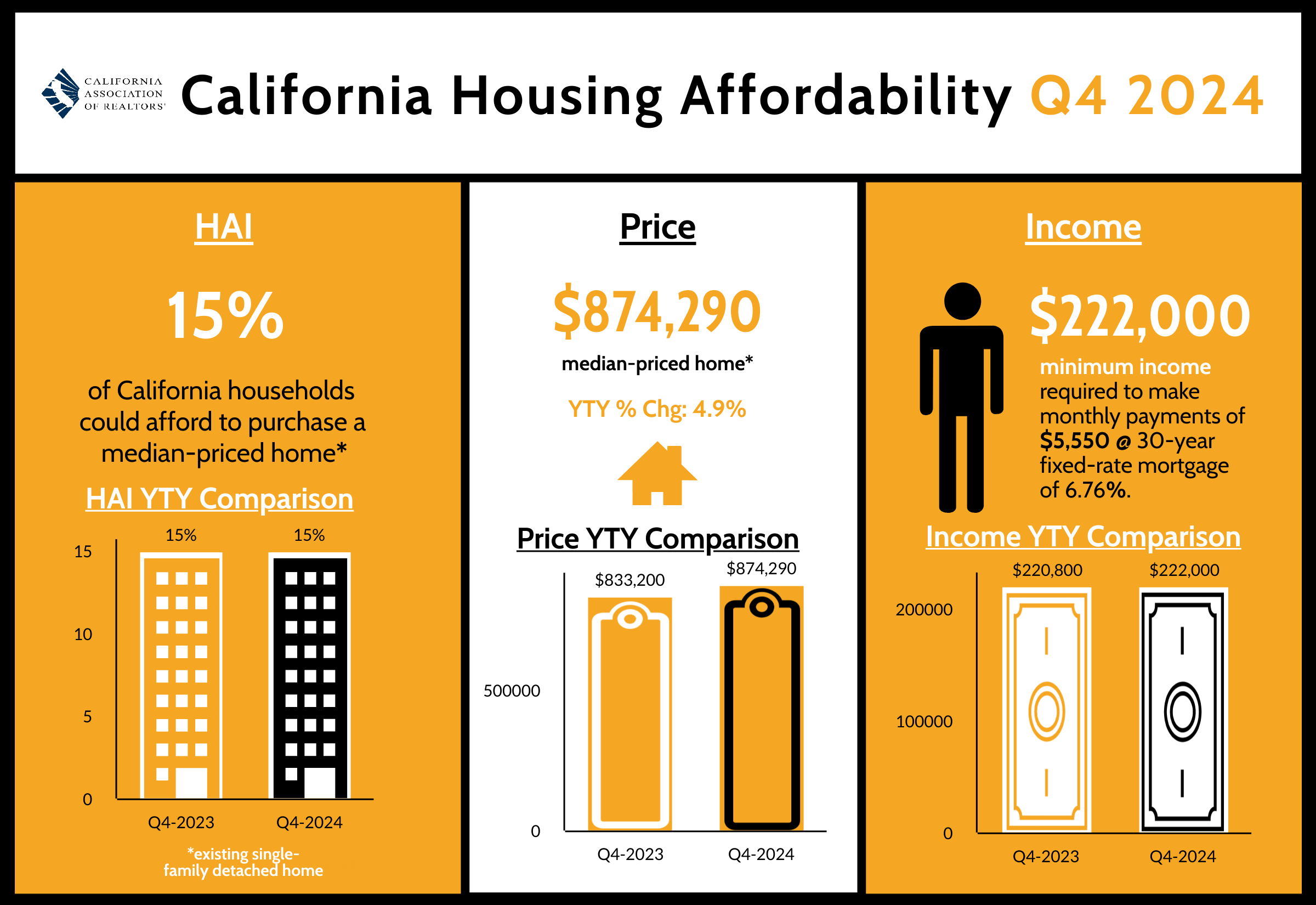

In early 2025, California’s housing affordability remained near historic lows, with just 15% of households able to afford the median-priced single-family home. High mortgage rates and rising home prices continued to limit market access for many buyers. While housing sentiment showed slight improvement, most consumers remained concerned about affordability, expecting further increases in home prices, rents, and mortgage rates. With mortgage rates expected to stay elevated, affordability challenges are set to persist in the coming months.

Q4 2024 Housing Affordability Index

In the fourth quarter of 2024, California’s housing affordability faced significant challenges due to rising mortgage rates and elevated home prices. Only 15% of households could afford the median-priced single-family home, which was $874,290. This marks a decline from 16% in the previous quarter and remains unchanged from the same period in 2023.

90% of Markets Saw Home Price Gains in Fourth Quarter

In the fourth quarter of 2024, nearly 90% of real estate markets experienced an increase in home prices, reflecting a robust recovery despite previous economic uncertainties. According to the latest data from the National Association of REALTORS®, the trend was most prominent in small and mid-sized metro areas, which saw notable gains. Additionally, inventory remained tight, contributing to price hikes in many regions. The report highlights how resilience in local housing markets, combined with persistent demand and limited supply, has kept prices on the rise across the majority of markets.

Why New Homes Are Getting Smaller

New home sizes are shrinking, with many buyers now opting for smaller square footage. The trend reflects changing priorities, as affordability, sustainability, and a desire for more efficient living spaces drive decisions. With rising construction costs and interest rates, buyers are increasingly seeking homes that are more functional than expansive. While the larger, sprawling homes of the past may have dominated the market, the shift toward smaller homes is signaling a shift in how people want to live in their spaces, focusing on quality over quantity.

Housing Market & Economy Show Strength as 2025 Begins: Rising Home Sales, Business Optimism, and Job Stability

The housing market and economy started 2025 strong, with rising home sales, growing business optimism, and stable job numbers. Falling mortgage rates may boost homebuying demand as spring approaches.

Gains in Home Sales Offer Hopeful Sign for 2025

Despite challenges, gains in home sales suggest a positive outlook for 2025. With increasing buyer demand and stabilizing market conditions, experts are optimistic for a more balanced housing market.

How Home Sellers Can Use Concessions to Get to Closing

Using concessions strategically, such as offering financial incentives or assisting with inspections, can help sellers motivate buyers and close the deal faster, even in a competitive market.

Dropping Mortgage Rates – Finally a Good Time to Buy?

Dropping mortgage rates may present a great opportunity for buyers to lock in lower payments. Experts suggest considering timing, personal financial stability, and market conditions before purchasing.